Cryptocurrency quotes

[ccpw id=”12695″]

Unintended consequences: Sanctions on Russia hurt US dollar dominance

Unintended consequences: Sanctions on Russia hurt US dollar dominance — RT USA

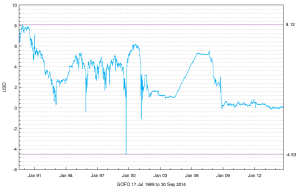

The US dollar, the dominant global currency since 1944, may lose some of its luster due to the American-led sanctions against Russia over the turmoil in Ukraine. The greenback has been fading in favor since the global financial crisis in 2008.

The US-led sanctions against Russia may have backfired on the US because it threatens to “hasten a move away from the dollar that’s been stirring since the global financial crisis [in 2008],” Rachel Evans at Bloomberg wrote. In an unexpected turn of events, Hong Kong’s central bank has bought more than $9.5 billion since the start of July “to prevent its currency from rallying as the sanctions stoked speculation of an influx of Russian cash,” she noted.

“OAO MegaFon, Russia’s second-largest wireless operator, shifted some cash holdings into the city’s dollar,”according to Bloomberg. “Trading of the Chinese yuan versus the Russian ruble rose to the highest on July 31 since the end of 2010, according to the Moscow Exchange.”

In March, after Crimea voted to secede from Ukraine and join Russia, the US and European Union imposed visa restrictions on Russians and Crimeans whom they considered “most directly involved in destabilizing Ukraine, including the military intervention in Crimea.”America and the EU expanded their economic punishment later in the month, as well as twice in April, once in May and twice in July, according to Debevoise & Plimpton, an international financial law firm.

In the latest round of sanctions, issued on July 29, the European Union imposed broader sanctions to “limit access to EU capital markets for Russian State-owned financial institutions, impose an embargo on trade in arms, establish an export ban for dual use goods for military end users and curtail Russian access to sensitive technologies particularly in the field of the oil sector.” President Barack Obama announced the US would also be “blocking the exports of specific goods and technologies to the Russian energy sector,” “expanding sanctions to more banks” and “suspending credit that encourages exports to Russia.”

The dollar’s dominance has shrunk over the last 13 years, from 72 percent of global currency reserves to 61 percent today, threatening the position that the greenback held since the Bretton Woods Conference in July 1944, when delegates from 44 Allied countries met in New Hampshire to hammer out a way to regulate the international monetary and financial order after the conclusion of World War II. Each signatory agreed to adopt a monetary policy that maintained the exchange rate by tying its national currency to the US dollar and to prevent competitive devaluation of its money. At the time, the dollar was pegged to the price of gold. In 1971, President Richard Nixon took the US off the gold standard, and the American banknote became the reserve currency around the world. Certain commodities, like oil, are priced in US dollars, regardless of the country of origin.

“The crisis created a rethink of the dollar-denominated world that we live in,” Joseph Quinlan, chief market strategist at Bank of America Corp.’s US Trust, which oversees about $380 billion, told Evans. “This nasty turn between Russia and the West related to sanctions, that can be an accelerator toward a more multicurrency world.”

The wording of the economic penalties may also negatively impact the greenback’s standing as the world’s reserve currency.

TDS: Gold Ripe For Short-Covering Rally If U.S. Economic Data Weak

Gold could stage a short-covering rally if economic data should be weak, says TD Securities. The metal has been under pressure since mid-August. “The choppy nature of the current (economic) recovery is likely to prompt the market to adjust its interest rate expectations, which would reduce the discount rates for zero-yielding assets such as gold and may force short covering,” TDS says. Friday’s U.S. nonfarm payrolls report “could be the catalyst that convinces traders that higher interest rates sooner are not a riskless bet.” Many investors have dumped metal from their portfolios on the expectations the U.S.

High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing

All we have is this small scale scapegoat jailing. All the big fish criminals from large WS banks are still at large and in charge.

High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing

U.S. Attorney’s Office

October 02, 2014

Northern District of Illinois(312) 353-5300

CHICAGO—In the first federal prosecution of its kind, a high-frequency trader was indicted for allegedly manipulating commodities futures prices and illegally profiting nearly $1.6 million as a result of trading orders he placed through CME Group and European futures markets in 2011. The defendant, Michael Coscia, was the manager and sole owner of the former Panther Energy Trading LLC, of Red Bank, N.J., which he formed in 2007.

Coscia, 52, of Rumson, N.J., a registered commodities trader since 1988, was charged with six counts of commodities fraud and six counts of “spoofing” in a 12-count indictment returned yesterday by a federal grand jury, Zachary T. Fardon, United States Attorney for the Northern District of Illinois, and Robert J. Holley, Special Agent-in-Charge of the Chicago Office of the Federal Bureau of Investigation, announced today.

The indictment marks the first federal prosecution nationwide under the anti-spoofing provision that was added to the Commodity Exchange Act by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act.

Coscia will be arraigned on a date to be determined in U.S. District Court in Chicago.

“Traders and investors deserve a level playing field, and when the field is tilted by market manipulators, regardless of their speed or sophistication, we will prosecute criminal violations to help ensure fairness and restore market integrity,” Mr. Fardon said. “This case reflects the reasons why, earlier this year, we established a Securities and Commodities Fraud Section, which is dedicated to protecting markets and preserving investors’ confidence,” he added.

According to the indictment, high-frequency trading is a form of automated trading that uses computer algorithms for decision-making and placing a high volume of trading orders, quotes, or cancelation of orders in milliseconds. Coscia designed two computer programs he allegedly used in 17 different CME Group markets and three different markets on the London-based ICE Futures Europe exchange, including gold, soybean meal, soybean oil, high-grade copper, Euro FX and Pounds FX currency futures, to implement his fraudulent strategy. It was illegal for traders to place orders in the form of “bids” to buy or “offers” to sell a futures contract with the intent to cancel the bid or offer before execution.

Between August and October 2011, Coscia allegedly defrauded participants in the CME Group and ICE Futures Europe markets. In August 2011, Coscia began a high-frequency trading strategy in which he entered large-volume orders that he intended to immediately cancel before they could filled by other traders, the indictment alleges.

Coscia devised this strategy to create a false impression regarding the number of contracts available in the market, and to fraudulently induce other market participants to react to the deceptive market information he created, the indictment states. His strategy moved the markets in a direction favorable to him, enabling him to purchase contracts at prices lower than, or sell contracts at prices higher than, the prices available in the market before he entered and canceled his large-volume orders, it adds. Coscia then allegedly repeated this strategy in the opposite direction to immediately obtain a profit by buying futures contracts at a lower price than he paid for them, or by selling contracts at a higher price than he paid for them. Each such trade allegedly occurred in a matter of milliseconds. As a result of the aggregate of those fraudulent high-frequency trades, Coscia illegally profited approximately $1,592,867 over approximately three months, the indictment alleges.

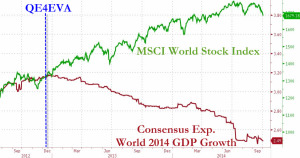

Huge disconnect between overblown stock market bubble and the economies has the IMF worried

•LAGARDE SAYS DISCONNECT BETWEEN MARKETS, ECONOMY ‘QUITE WORRYING’

•LAGARDE SAYS FED’S QE POLICY HAS ‘DONE MUCH TO AID RECOVERY’

•LAGARDE SEES WORRY MARKET, LIQUIDITY RISK MOVING TO ‘SHADOWS’

•LAGARDE: GLOBAL RECOVERY `BRITTLE, UNEVEN AND BESET BY RISKS’

•LAGARDE: WORLD ECONOMY NEEDS BOLD MOVES TO AVOID `NEW MEDIOCRE’

Swiss Gold Referendum Attracting Attention Two Months Ahead Of Vote

A referendum on Switzerland’s gold reserves is starting to attract some attention outside of the country as a yes vote would have significant implications for the gold market, said one market analyst.

On November 30, Swiss citizens will go to the polls to vote on three areas; whether or not the Swiss National Bank should increase its gold reserves to 20%, that the central bank should stop selling its precious metals and that all its gold should be held within the country….

In a research note published Sept. 24, Analysts at UBS said that if the referendum passes the Swiss National Bank would have to buy about 1,500 tons of gold over the next three years. “1500 tonnes equates to half of the world’s annual production,” they said in the report.

“That kind of gold buying would put what we’ve recently seen in China to shame,” said Hansen.

The UBS analysts also noted that so far the referendum has not attracted a lot of attention outside of the country.

To US Fed – thank you for saving the gamblers in 2008. They should have been jailed.

We are told there is no bubble, except in gold, of course. Who would want the barbaric relic?

Since 2009 gold price was determined by the gold/dollar swap rate, which fluctuated between plus or minus 0.1%. When this rate was negative 0.1%, meaning that gold yielded 0.1% (per year) more than USD, gold rallied $100. When it was positive, gold tanked $100. Isn’t it amazing that the difference in Yield of a mere 0.1% causes $100, $200 move in price? Isn’t it great to actually be one of the setters of gold interest rates in London? Think about it!

Manipulation of Libor has been the scandal of the recent years. Why not Gofo? But of course!

The King Dollar trade

With the USD experiencing its longest stretch of weekly gains since Bretton Woods, it appears, as SocGen notes, that recent currency movements have triggered nostalgia of the pre-crisis world when dollar strength was synonymous with a prosperous global economy. However, given the extreme positioning and potential for policy-maker complacency, SocGen warns the paradox is thus that a strong dollar tantrum could be a more worrying scenario than a Fed tightening tantrum.

More here

Kitco Gold survey – a great contrarian indicator.

Kitco gold survey has been a great indicator… in reverse. So, this week’s survey is forecasting a strong advance for gold prices in the week ahead.

A majority of participants forecast lower gold prices next week in the Kitco News Gold Survey as dollar strength and bearish technical-chart formations weigh on the metal.

Out of 37 participants, 20 responded this week. Of those, four see higher prices, 12 see lower prices and four see prices trading sideways or are neutral. Market participants include bullion dealers, investment banks, futures traders and technical-chart analysts.

Last week, survey participants were bearish. As of 11:30 a.m. EDT, Comex December gold was down about 50 cents for the week.

Those who see weaker prices said there’s little incentive to buy gold in the short-term, with a test of $1,200 an ounce possible.

“It’s got a bit of a negative profile here,” said Charlie Nedoss, senior market strategist at LaSalle Futures Group. “The dollar is weighing on it. It’s still under the 10-day (moving average), which is about $1,224.80 (basis the December futures). It’s ridden that all the way down. I can’t really start to get excited until it can get over that. And the 20-day is at $1240.21.”

More here

USD/EURO short term trends

Here are 30-day channel and 60-day regression trends for USD/Euro currency pair